Highlights

The Rise of Ethereum Casinos on Nova Scotia’s South Shore

Nova Scotia’s South Shore, known for its stunning landscapes and maritime charm, has recently found itself at the forefront of a digital revolution—Ethereum casinos. As the Ethereum blockchain gains popularity, the region has become a hub for innovative gaming platforms that leverage cryptocurrency. Amidst the picturesque coastal scenery, these cutting-edge casinos redefine the intersection of technology and entertainment. Timesunion reported that this unexpected development has not only drawn attention to the region’s technological prowess but also sparked a new wave of tourism eager to experience the future of gaming against the backdrop of Nova Scotia’s natural beauty. In this article, we’ll explore the remarkable rise …

5 Known Benefits of Kratom

Kratom has long been used for its medicinal properties in certain parts of Southeast Asia. The leaves of the Kratom tree contain compounds that can have varying effects on the body, depending on the dosage. Happy Go Leafy enthusiasts often appreciate the natural, botanical qualities of Kratom, finding solace in the delicate balance it brings to their well-being. Here are five known benefits of Kratom, which have contributed to its growing popularity. Pain Relief Kratom’s ability to provide pain relief is one of the primary reasons for its use. Pain can be categorized into two types: nociceptive and neuropathic. Nociceptive pain is caused by physical …

5 Ways to Boost the Cannabis Industry’s Sustainability

People across the globe are now finally appreciating the benefits of cannabis. More and more nations nowadays are permitting the legal consumption of cannabis products for both medical and recreational use. As a result, the cannabis industry is growing exponentially at a rapid pace. With that said, the biggest challenge right now is the potential environmental impacts associated with the trade of cannabis products such as premium THCa pre rolls. The production and transportation of cannabis mainly play a huge role in the consumption of natural resources. Top Ways to Achieve a More Sustainable Cannabis Industry Below is a rundown of the top ways to …

Solar Energy: Finest Choice Among Cannabis Companies

Cannabis cultivation is central not only to the Cheefbotanicals online store. And, as technology advances, cannabis producers are going green. They begin to use solar energy to power their buildings. Not only are growers beginning to use solar electricity, but merchants and distributors are as well. Most business owners have realized that putting money into solar panels creates a sustainable and lucrative future for what they do. Since the early, illegal days of marijuana cultivation, growers have used solar panels to reduce suspiciously high utility costs. Growers are turning to solar to meet their financial goals as commercial operations expand in size. Why Cannabis Cultivation …

How Much Do You Need to Spend on Solar for Your Pool?

You are likely considering having a solar heater for your pool or comparing solar pool heaters. We understand that the cost is one of the biggest factors when it comes to solar pool heating. Continue reading to have an idea of how much you need to spend on a solar pool heating system and its advantages and disadvantages so that you can weigh if the cost is indeed worth it. How Much Do You Need to Spend on Solar for Your Pool? Pools are a great way to spend time with your family. However, you don’t have to wait for summer to be able to …

Cultural Center to Host a Workshop, Register Now!

Are you a flower enthusiast? If you are, then you don’t want to miss the chance to learn new skills like flower arranging in a workshop that is hosted by Firehouse Cultural Center. The workshop includes supplies that you will use for only $45, and you can take your output with you. Laura Nation, a Florida State Master Designer, is the facilitator. She will be sharing her experience for 30 years in the business. Moreover, she will cover the basic skill of making a lovely bouquet. Participants will also get the chance to ask related questions. The upcoming workshop is the second floral design workshop …

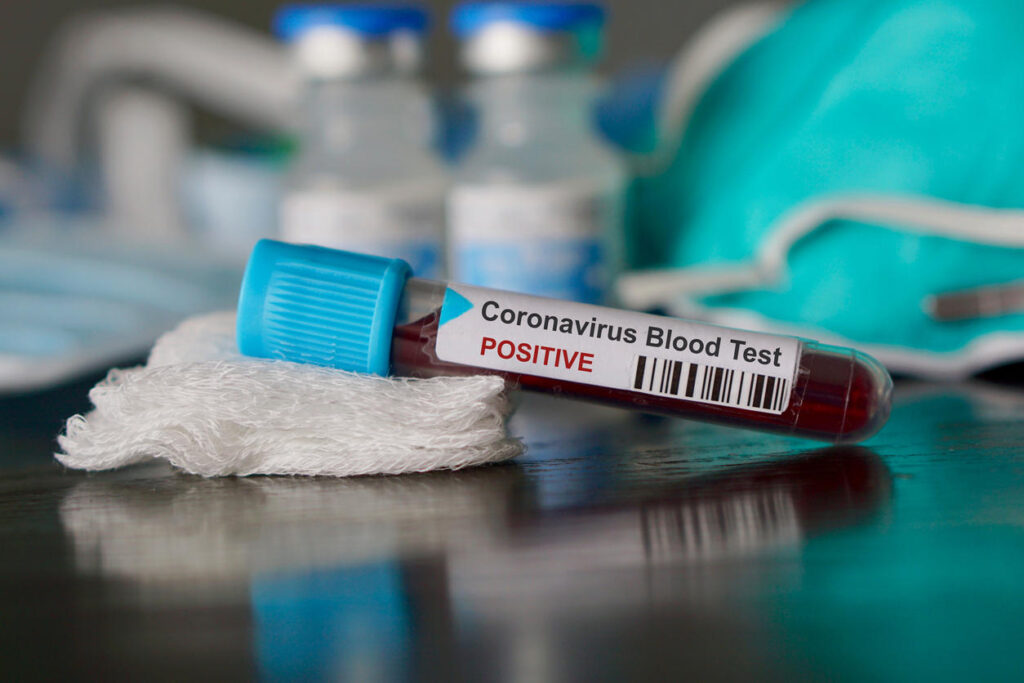

Passenger from the USA Tests Positive for COVID-19

According to the provincial Health Department, a man who travelled from the United States to Nova Scotia tested positive for COVID-19. The man who was going to Prince Edward Island through Nova Scotia tested positive on Sunday. As per the initial report, it was determined that the man was from the United States. However, it was later established that he’s a foreign national studying in Prince Edward Island and not from the U.S. Three positive cases of COVID-19 that were reported on Prince Edward Island were linked to the man. A resident of P.E.I., who had been in contact with the man, tested positive for …